Is Oklo a good bet?

Oklo is building a next gen small module reactor that reminds me of Ford's Model T. It won't be the first nuclear reactor, but there's a decent chance that it will be the first to go mainstream.

There are several reasons for this.

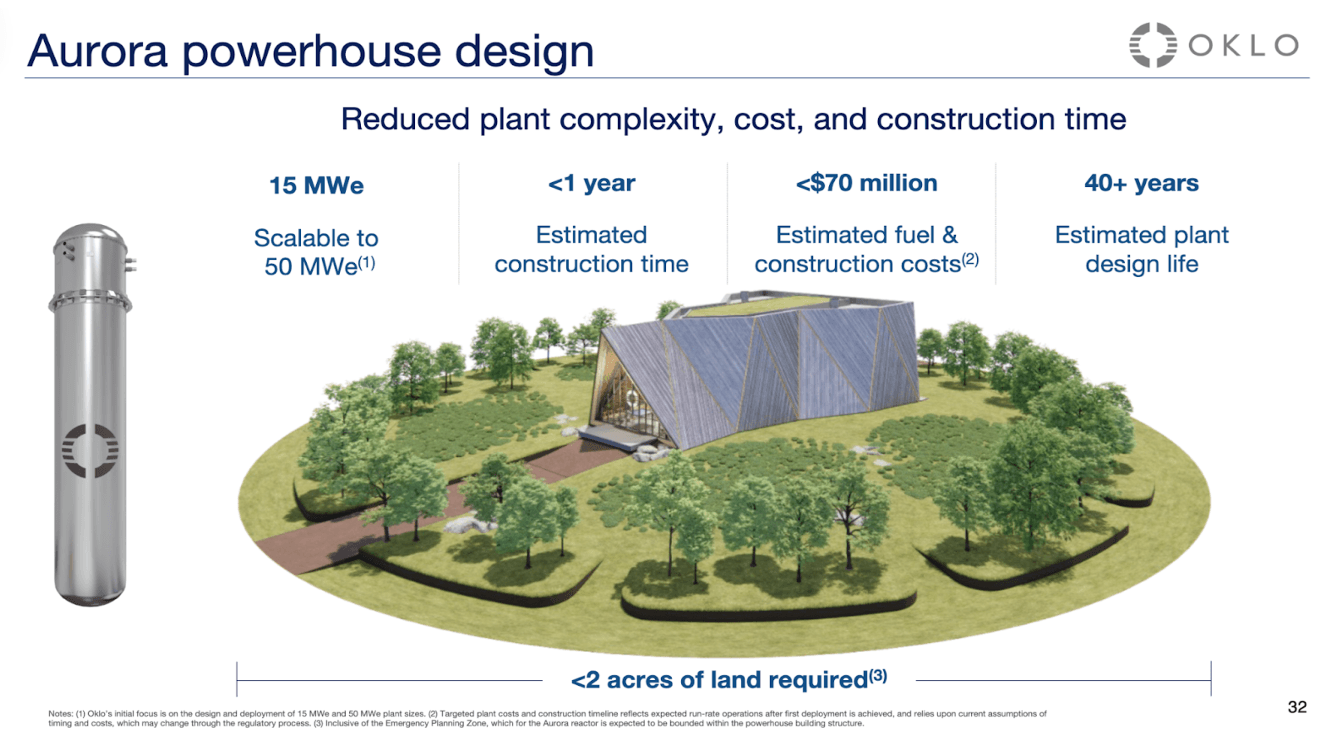

- Previous generations projects cost billions more than expected and were years behind schedule. Oklo's is aiming for the sweet spot where a single powerhouse would cost less than 70 million, be built in under a year, and profitable within seven years.

- Oklo will be building and operating their own plants so that customers can simply buy the electricity. This is important because data centers and other potential buyers don't want to get into the nuclear game. They simply want clean, reliable, and affordable energy.

- Oklo's is building on top of the ERB-2 design which is proven, simple, safe, and can run off of recycled fuel. This lets them streamline the licensing and production process and offer energy at a price comparable to natural gas.

If you'd like to learn more, I recommend checking out the investor day deck and presentation. They made it super approachable and have a great way of telling the story. My goal with this post is to organize my own thoughts. These wree the questions I had and I think you'll find the answers are pretty exciting.

#Why now?

Industries like nuclear are incredibly difficult to stand up. However, there are a couple of reasons why today might be special.

- AI is driving a massive growth in data centers. Today, they represent 2.5% of all U.S. energy consumption and they're expected to grow to to 7.5% by 2030. Data centers alone would represent 30 GW of new energy [4].

- Existing coal plants are aging and we're on track to retire 100GW by 2030 and 200GW by 2050 [3].

- Transitioning towards electric cars, heat pumps, and off of gas could double or triple electricity demand.

- Moving manufacturing back to the US and onshoring semiconductors development and other factories will drive demand for energy.

- The US has set a goal of 200GW new nuclear energy by 2050 which would triple US nuclear production from 100GW to 300GW [1].

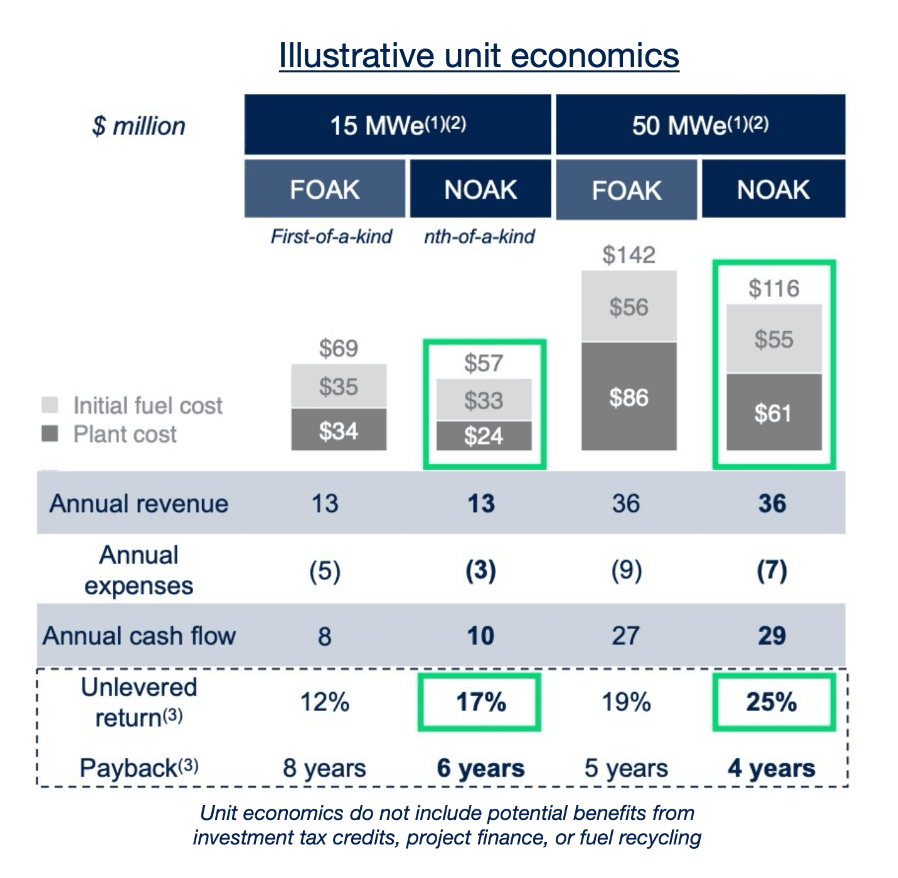

#What are Oklo's economics?

Oklo is building an owner operator business where they sell electricity to customers directly through 20-40 year Power Purchase Agreements (PPAs). This is attractive to data centers and utilities who do not want to be in the Nuclear game and are willing to pay more for clean and reliable energy.

It also has other benefits as well:

- Highly sticky recurring revenue

- Financed development plans

- Investment Tax Credits from the IRA which can be as much as 30-50%

- Combined licensing agreements from the NRC which reduce compliance times

- Scaled operations / maintenance costs

The best way to compare costs across power plants is to look at the levelized cost of energy (LCOE) over the lifetime of the plant. Oklo believes that they can bring the LCOE on a per MWh basis down from $90 to $40 as they go from their first power house (FOAK) to the 20th (NOAK).

There are several assumptions which I list below, but the $40 MWh is exciting because it would be cheaper than renewables + battery and natural gas with carbon capture. Straight solar is in the $20s, onshore wind is in the $30s, and natural gass is in the $40s, so $40 MWh would put them in the ball park of natural gas and would be reliable in a way that renewables are not.

Importantly, their pipeline is now 2.1 GW and on good terms. For example, they recently added Equinix

they claim that these customers are not sensitive on price.

Time will tell though since these are non-commital, but it is easy to see how data centers who are running up against energy availability concerns would be eager to standup an alternative to renewables and natural gas as they scale their power demands.

Oklo's assumptions on LCOE:

- Upper limit LCOE based on FOAK single unit plant without investment tax credit (“ITC") benefit. Lower limit LCOE based on NOAK single unit plant with ITC benefit.

- Estimates for Oklo LCOE range assume:

- All regulatory approvals have been obtained on expected timelines;

- a run-rate of 20 units to achieve NOAK unit economics;

- 30% ITC with 90% transferability;

- power outputs of 15-50 MWe; total refueling capital expenditures over the expected 40-year life of the Aurora powerhouse assumed to be $53-84mm;

- excludes overnight cost contingency or decommissioning cost;

- levelized average lifetime cost approach, using the discounted cash flow - F") method; and

- a weighted-average-cost of capital of 8% based on the International Energy Agency sensitivity analysis range of 4-8%.

#What about fuel recycling?

When you listen to the CEO, Jacob DeWitte, talk about Oklo's future, he keeps coming back to the potential of fuel recycling. There are a couple of statistics that bring this to life.

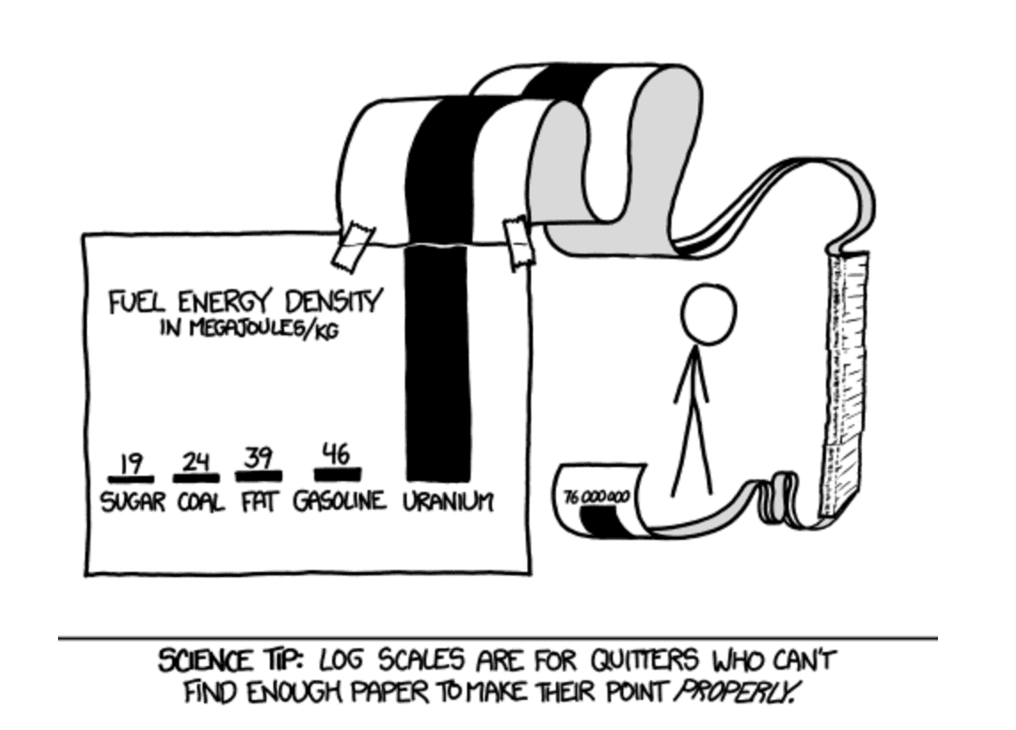

Recycling has the potential to reduce their fuel costs by 80%. Given that 50% of the cost of a plant comes from fuel, you can see how important this might be, but there is a second point that's potentially more profound.

The U.S. currently has 90k tons of waste fuel and generates 2K tons of waste fuel a year. Fun fact, the US government currently pays a million dollars a day to store it. And here's the kicker, current reactors only use 5% of the fissile material, so if you scale's Oklo's design and fed it only waste fuel you'd have enough energy to power the US at current demand for a century. One year's waste is enough to power current demand for four years.

And it gets more fantastical, with the uranium believed to be underground, there would be enough energy to power 10 billion people for 10 billion years.

Coming back down to earth, the opportunity to reduce their fuel costs by 80% is the strongest concrete argument that they'll be able to significantly reduce their costs as they scale. Other arguments include standardization and partnerships opportunities which simplify operations and maintenance. When combined with financing opportunities, it's possible to see how each power plant could have a short payback time and help them scale fairly efficiently.

And then there's always the physics argument that fuel's like coal and gas have an energy density of 20 and 50 MJ/kg while uranium has an energy density of 3,900,000. If you follow this argument to its logical conclusion, it leads you to cheap abundant energy.

Over the long term, there's always the question of how well they'll be able to defend their margins. I don't understand the energy sector well enough, but if we're in a world where SMRs are replacing coal and natural gas as the primary baseload power, shrinking margins should be a first world problem andit was only 2013 when Exxon was the world's most valuable company!

#Risks

It's easy to look at a company like Oklo and see many of the risks they face, but their february investor day webinar and deck did a good job of showing me that they're taking them seriously and there's a good chance that the market has priced in how much they have been de-risked.

#What is the regulatory timeline

Oklo is working on attaining a custom combined license (COLA) for design, construction, and operation of the Idaho National Lab demonstration plant. This application will serve as a reference COLA and will make it easier to receive subsequent COLAs in the future.

They have had a long relationship with the NRC starting in 2016, an initial application in 2020 for the Idaho National lab project which was rejected in 2022, and will be re-sumitted early next year with the goal of being approved early 2027. At this point 10% of Oklo's team is former NRC employees and there's no getting around the fact that planning and licensing is a major component of what they do.

With that said, there is evidence that the NRC has been reforming over the past decade with each administration bringing in more supportive leadership and updates they've been making to the licensing process.

Two examples of this are the combined licensing application which lets Oklo get permitting for the design and construction at the same time and their new subsequent review process which treats the initial application as a reference and avoids re-reviewing redundant sections. Because of Oklo's owner operator model where they both design and build the plants, they were the first to take advantage of the COLA benefits. And when it comes time to file the second COLA, they expect that it will take 6 months to complete.

At this point, there's significant evidence that nuclear is one of the rare bi-partisan issues. The IRA made it possible for nuclear firms to claim a 30% investment tax credit and introduced the idea of transferability which would make them re-sellable. There are additional benefits such as production tax credits, plants that are built along side retiring coal sites, etc etc. There's also a 900 million dollar Investing in America fund which serve as loans for Gen III SMR Light Water Reactors. Oklo is building a Gen IV plant, but this is a good example of additional financing opportunities that could become available to help facilitate the development of the first N plants [5].

And for what it's worth, Chris Wright, Trump's nominee to lead the department of energy, is on Oklo's board and the chairman of the board is Sam Altman so there's no shortage of friends in high places!

#What about NIMBYism?

The Oklo team points to a couple of factors that re-assured me that public sentiment might be shifting towards YIMBYism.

- The Diablo california nuclear reactor was scheduled to be shut down before local public pressure pushed for the plant to remain open. The announcement that Three mile will also be re-opening has also been positive. Same goes for Japan and other re-activations.

- There pipeline is being driven by data centers who want to put the reactors on their properties which is possible because the power house is less than 2 acres. This demand is real and would be harder to push back against than a new public project.

- There is an example of a commercial real estate company that would like to power a new community with Aurora power. They would not be interested if they were afraid of NIMBYism.

- The A Frame design of the plant could play a role in changing public perception and speaking to the inherent of the design. We'll discuss safety below, but put simply risks require redundancy which increase complexity anything this simple must be safer by design.

- Jacob DeWitte points to the internet as helping change public perception around the benefits and safety of nuclear.

- This might sound silly, but I think there's a reasonable argument to be made that the A Frame design of the plant could play a role in changing public perception. The design which comes from Gensler could not be a bigger contrast with the brutalist towers of the past and in an intuitive way speaks to some of the safety and security concerns we'll look at below.

#What are the safety concerns?

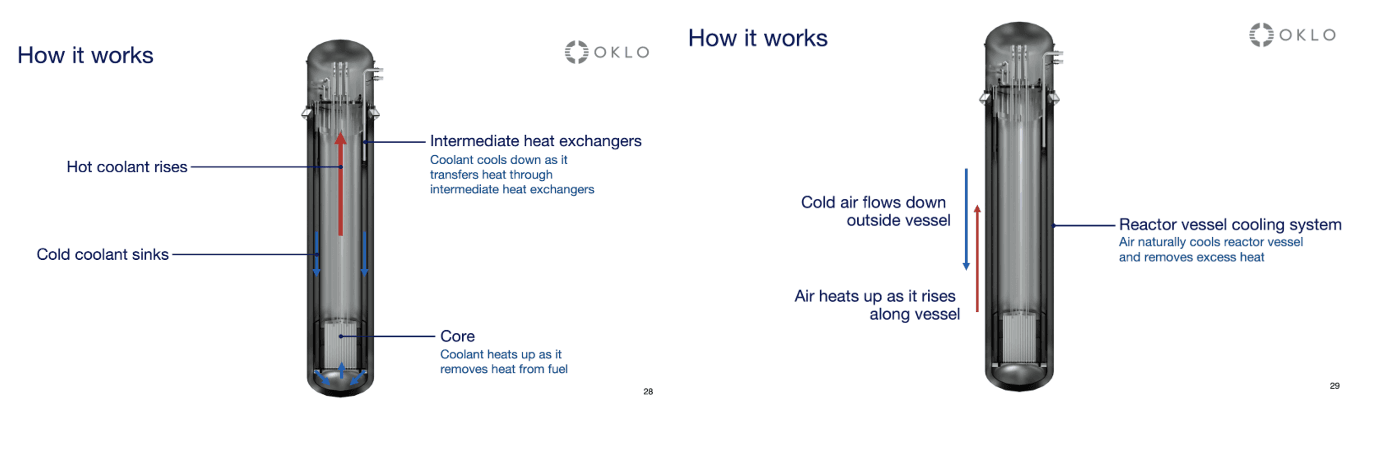

I don't know the science well enough to claim to speak on the safety concerns, but the point that impressed me was that they inherited a safe-by-design from the ERB-II reactor which operated for 30 years and generated 20 MWe.

The important feature is that it does require an external shut-down actuation. The system will self-stabilize, self-control, and cool by natural forces. The CEO, Jacob DeWitte, talked about their safety by physics approach which is another way of saying that they did not need to add any extra safety systems in. As the core gets hotter the fuel will naturally separate and the reaction will slow down. If the vessel were to heat up, hot air will rise and cold air will flow down. Moreover, the plant does not even require an on-site operator.

While not directly related to safety, they also made the point that safety measures are often the biggest cost and compliance drivers so the safe-by-physics design is a big efficiency driver.

#How does Oklo compare to competitors?

This is another area where I don't feel very qualified to speak, but here is my high level understanding.

- NuScale is the other new entrants who recently went public. They've received licensing approval, are in the deployments stage, and the furthest along. They're targeting 300 MW plants with a Gen III light water reactor design. They'll probably have an initial advantage, but could struggle to reach natural gas LCOE targets.

- Terrapower is a private Gates backed startup. They're pursuing a design that's similar to Oklo's but also targeting a 300 MW and have not decided on whether they'll build out the plants themselves or license the technology to other partners. Since they're private, it's hard to find their LCOE projections or pipeline.

- Kairos is another private startup that's taking a different Gen IV approach. Their claim to fame is they recently signed the first corporate agreement for nuclear energy with Google.

- Finally, there's GE Vernova which spun out of GE in April and by virtue of focusing on power, wind, and electrification is a goliath. They're BMRX-300, is a Gen III design similar to NuScale and there are several deployments underway in Ontario canada as well as interest notably in the UK and Sweden.

#What about the balance sheet?

My hunch is that the biggest risk that a company like Oklo has is time and their ability to raise on good terms if there are significant delays. Short of a Cruise style disaster which is minimal, the worst case scenario is that there are delays and cost overruns that would cause them to miss their 2027 timeline for completing the Idaho National Laboratory project and the three other projects which are in the works: two in Ohio and one in alaska.

At the moment, their balance sheet looks strong and they have a track record of hitting their goals, but that could always change [6].

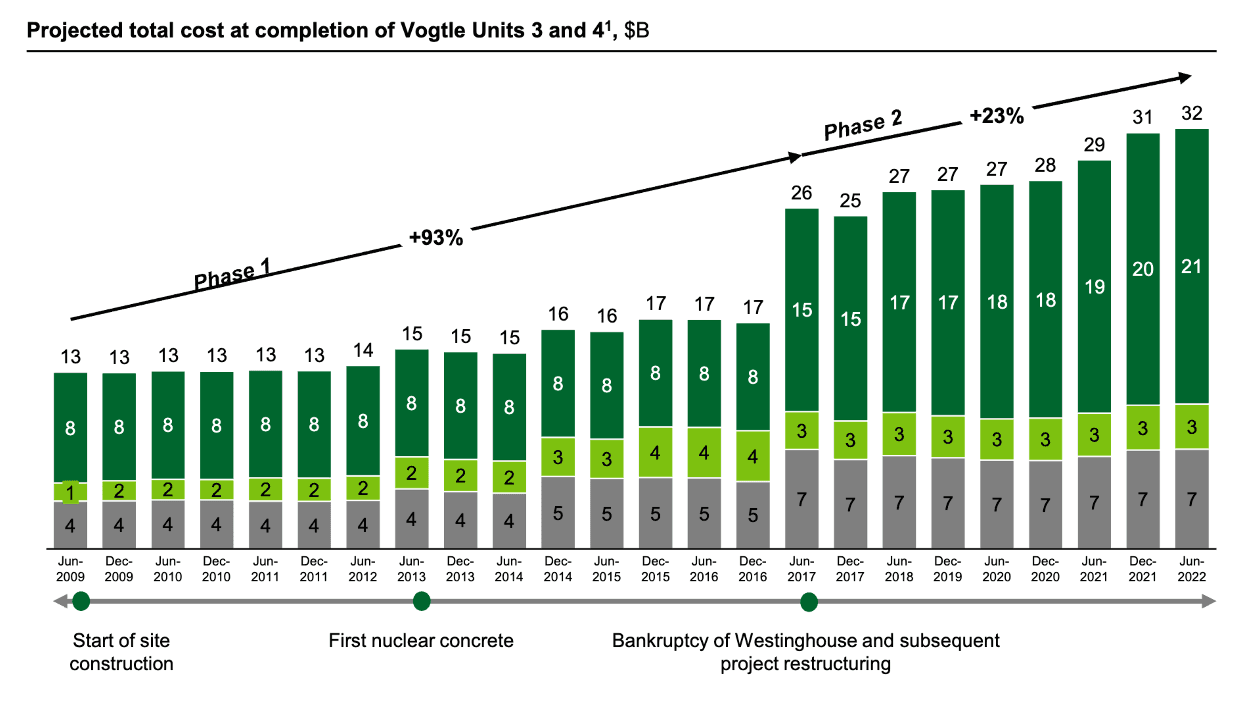

There are two cautionary tales that are worth mentioning here. The first is Georgia Vogtle nuclear reactor which was expected to take 8 years, but ended up taking 14 years and was expected to cost 13 billion, but ended up costing 32 billion.

The second is NuScale's first deployment, the Carbon Free Power Project (CFPP), where they partnered with the Utah Associated Municipal Power Systems (UAMPS) to develop a small modular reactor (SMR)..

The project aimed to construct a 720-megawatt electric (MWe) facility at the Idaho National Laboratory near Idaho Falls, Idaho, comprising twelve 60 MWe nuclear power modules. The project was approved in 2020 when the DOE agreed to a 1.4B cost-share with the goal of being completed by 2030 and a target cost of $5.3b and LCOE projection of $58/MWh and was terminated in 2023 when the projection was revised to 9.3 billion and $89/MWh and there was less demand from the utilities than expected.

Both of these stories stress the risk of building a first of a kind nuclear facility. With the CFPP, some of the factors were post-pandemic supply chain disruptions, but many others came from engineering adjustments required by the regulatory process that increased the complexity and cost of the project.

#Is this a good investment?

Let's put aside the speculative nature of the bet. It's a given that there are many assumptions here, revenue is at least two years out, and profits are many years after that.

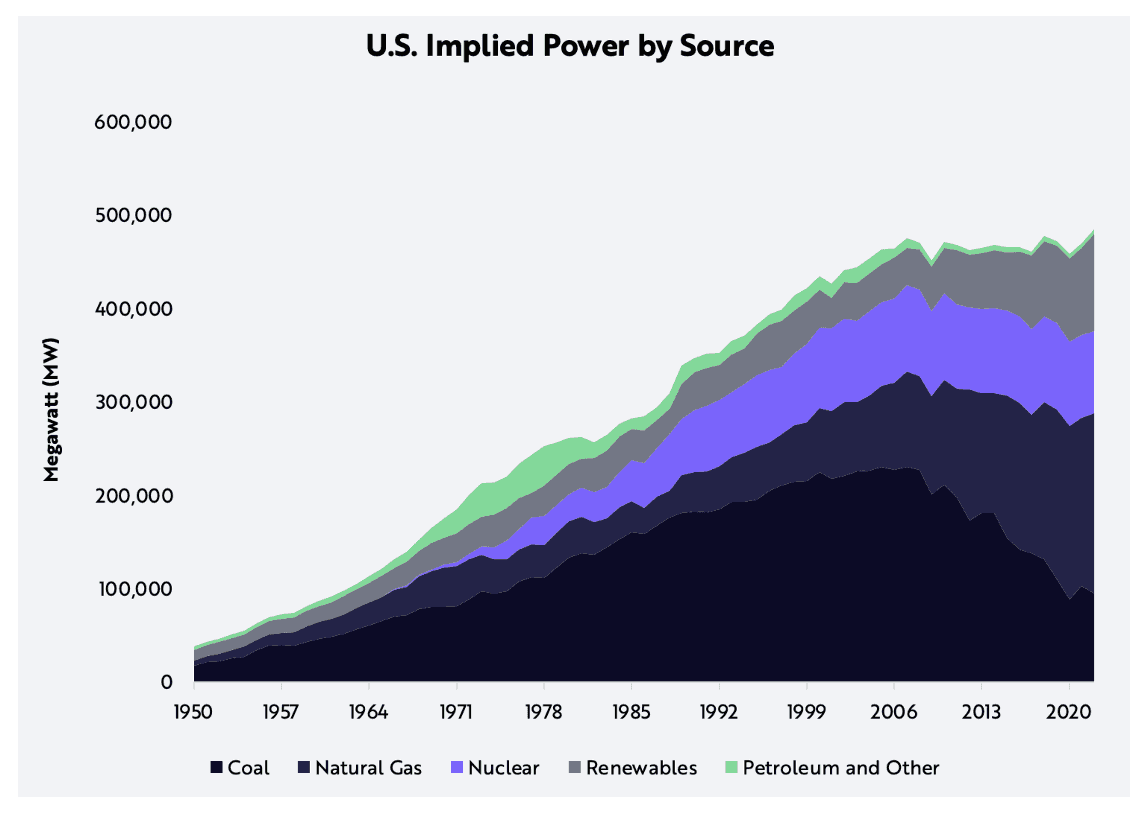

The more interesting question is will nuclear be able to earn its place alongside other mature energy sources. Today, nuclear accounts for about 8% of US energy production, but there has not been a new nuclear project started after 1975 (the date when the NRC was founded).

Put another way, we're talking about going from 0 new gigawatts of energy to 200 in the next 30 years. To do this successfully, we'll need to build an entire ecosystem alongside the reactor and do it quickly. This will require significant government and private investment coordination.

It's totally possible that any one of these systems could fail and already mature technologies like Solar and Natural gas could eat nuclear's lunch. For instance, more efficient carbon capture or battery technology could further push their cost curves down.

On the other hand, one only has to look at how the cost for solar has plummeted over the past 50 years leading to nearly 600 new GW of power being produced every year to believe that scaling laws and economies of scale do work [7].

Oklo is a ten year old company that's built on the back of 30 year old tech. Getting in today, two years before they complete their first plant, could be the opportunity to get in on the ground floor of the next Exxon. And the good thing about markets is that they tend to pull future forward, so the price will not wait for nuclear to win to move.

#Resources

1 DOE: Pathways to commercial liftoff

- U.S. domestic nuclear capacity has the potential to scale from ~100 GW in 2023 to ~300 GW by 2050—driven by deployment of advanced nuclear technologies.

- The 200GW would be a significant chunk of the needed ~550–770 GW of additional clean energy.

3 An ideal solution for replacing coal

- This growth in demand for data center services, particularly for GenAI, is driving up power usage and density. Data center electricity consumption was 2.5% of the U.S. total (~130 TWh) in 2022 and is expected to triple to 7.5% (~390 TWh) by 2030. That's the equivalent of the electricity used by about 40 million U.S. houses – almost a third of the total homes in the U.S.

- DOE estimates the U.S. will need approximately 700-900 GW of additional clean, firm power generation capacity to reach net-zero emissions by 2050

- The world is already on track to add nearly 600 gigawatts in 2024 — 334 gigawatts in China, 53 gigawatts in the US, and, stunningly, at least 16 gigawatts in Pakistan.

8 Nuclear Energy Could Contribute Meaningfully To Securing Net-Zero Emissions

9 Tech companies are investing in nuclear

- Microsoft: While Microsoft made headlines in September 2024 by announcing an agreement with Constellation Energy to revive the Three Mile Island nuclear power plant, it has also been researching SMRs behind the scenes. In October 2023, the firm posted a job description for a nuclear technology expert who will be asked to "ensure technical feasibility and optimal integration of SMR and microreactor systems."

- Alphabet (the parent company of Google): Announced on October 14, 2024, that it had agreed to purchase nuclear energy from SMRs being developed by Kairos Power and expects them to be up and running by 2030.

- Amazon: on October 16, 2024, Amazon announced an agreement with Energy Northwest, a consortium of Washington state public utilities, to enable the development of SMRs in Washington and is targeting the early 2030s.

- Amazon: On the same day, Amazon also announced a $500 million investment in X-energy, a leading developer of next-generation SMRs and fuel technology.

- Amazon: In addition to the aforementioned announcements, Amazon also disclosed an agreement with Dominion Energy to explore an SMR project near Dominion's existing North Anna nuclear power plant, a major data center hub in Virgina.